Content

- Harris Proposition to increase Business Taxation Speed Perform Harm Specialists in the All Congressional Area

- Certified Company Income (QBI) Deduction

- Zero taxation on the Societal Protection pros, or $4,100 senior ‘bonus’: The way they examine

- High school outreach to improve the fresh accounting tube

The newest deduction do start to stage aside to have unmarried filers with more $75,100000 within the changed adjusted revenues, as well as married people just who file as you with over $150,one hundred thousand. This type of applicable persons might possibly be susceptible to improved You.S. federal tax cost, along with part earnings taxation and you will FDAP and FIRPTA withholding. The brand new tax rates perform boost because of the five percentage issues a year, around a maximum of 20 commission issues above the legal price. The newest elder deduction for the phaseout brings a much bigger tax move lower-middle- and middle-earnings taxpayers compared to the unique strategy promise away from exempting all of the Public Defense benefits from money income tax. But considering the short term characteristics of your policy, it does improve the deficit feeling of one’s law rather than boosting long-work with economic development. The brand new Bbb tends to make four significant change to the surroundings for getting federal taxation advantages with regards to Sodium.

Harris Proposition to increase Business Taxation Speed Perform Harm Specialists in the All Congressional Area

For married couples which have shared money anywhere between $32,000 and you can $49,000, to fifty% of the professionals could be taxed. The fresh taxation plan includes a supplementary deduction all the way to $6,000 to have the elderly decades 65 and over. It can simply be offered by the newest 2025 thanks to 2028 income tax decades and certainly will supplement, although not change, the current additional fundamental deduction already offered to the elderly. Specific pros state that they had invited one recently tailored W-dos versions you may sooner or later is the fresh packets or codes to help you spell aside overtime one to qualifies to the income tax crack. Luscombe told you businesses are required so you can separately report the brand new qualifying overtime that will be advertised included in the income tax split.

Internal revenue service research implies that up to 1,100000 taxpayers satisfy these thresholds. Suggested amendments in order to Password § 174 would offer optionality in order to taxpayers to have domestic research and you may fresh (R&D) expenditures paid otherwise sustained within the tax many years delivery just after December 30, 2024, and from the restoring https://casinolead.ca/2-deposit-bonus-casino/ expensing to have Roentgen&D expenses. International R&D won’t take advantage of the suggested amendments and you can would be expected to remain capitalized more a good 15-seasons period. Originating in 2023, although not, the main benefit depreciation rates started initially to stage down incrementally, reaching 0% for possessions listed in provider inside 2027 (2028 for certain prolonged production several months property and specific routes). The newest TCJA briefly enhanced the new lifestyle house and you may provide income tax exclusion from $5 million for each individual $ten million for each individual.

Whenever they usually do not compensate for the newest money losings, that will cause incisions to help you Snap pros or says deciding out from the program entirely, considering CBPP. The brand new cuts could possibly get ultimately apply at over 40 million people, with respect to the Center on Budget and you can Rules Concerns. Complete with from the 16 million people, 8 million seniors and you can cuatro million non-more mature adults which have handicaps, and others, centered on CBPP, an excellent nonpartisan research and you will plan institute.

![]()

On the a dynamic base, adding the brand new projected boost in much time-focus on GDP of just one.2 per cent, the fresh active get of one’s taxation terms drops because of the $940 billion in order to $cuatro trillion, definition monetary progress will pay for in the 19 % of your own biggest tax cuts. Another dining table measures up the newest distributional effects of the elevated elderly deduction on the OBBBA to help you an exemption out of Public Shelter benefits out of taxable income less than TCJA extension. The increased elder deduction develops once-taxation profits to the lower-middle- and center-earnings quintiles more. The bottom quintile only observes a little rise in their after-tax money, as the fundamental deduction already largely wipes out its income tax responsibility.

Certified Company Income (QBI) Deduction

Enterprises might possibly be permitted to quickly subtract eligible home-based Roentgen&D expenditures paid back otherwise obtain birth once December 29, 2024. But not, costs to possess search conducted outside the You.S. would be needed to are nevertheless capitalized and amortized over fifteen years. The bill do improve the restriction amount an excellent taxpayer is debts to the depreciable business devices lower than Section 179 out of $step one.25 million to help you $dos.5 million. It could can also increase the newest phaseout threshold away from $step three.13 million to $cuatro million. Our house type manage pertain one hundred% bonus depreciation from January 19, 2025 from the stop from 2029. Listed here are specifics of a few of the tax provisions in the operate often called the main one Large Beautiful Expenses Work, which was closed on the rules Tuesday from the President Donald Trump.

Zero taxation on the Societal Protection pros, or $4,100 senior ‘bonus’: The way they examine

Changed adjusted gross income can be your modified revenues, that’s available on the internet eleven of the 1040 income tax come back, with things like offers bond focus extra into, according to the Internal revenue service. To help you qualify for the new deduction, a car in addition to should be put together in the You.S., and this subsequent limitations the brand new taxation crack. Nevertheless, auto buyers who’ve ordered a different vehicle this season otherwise are intending to exercise in the next couple of years could possibly get find some taxation rescue after they file the 2025 tax statements. The new deduction usually end inside the 2028, which means that vehicle buyers could only enjoy the work for for five income tax ages.

High school outreach to improve the fresh accounting tube

- The brand new exclusion try frozen as part of the 2017 tax laws beginning in 2018 and you can try arranged to go back at the end from 2025.

- Make zero error about it, Trump breaking his Personal Protection guarantee has nothing to do with popularity.

- The Senate and Home models of your costs would make the fresh TCJA individual taxation rates permanent and you will perform modify the rising cost of living adjustment system to possess personal tax mounts.

- The newest taxation law raises specifications that will has tall implications for your summary.

Depending on the JCT, these motions will increase profits from the more $300 billion. For many years, the brand new You.S. got struggled that have simple tips to lose firms that earned payouts to another country. Essentially, the global income tax program imposes taxation to the all the income made because of the You.S. taxpayers, irrespective of where earned.

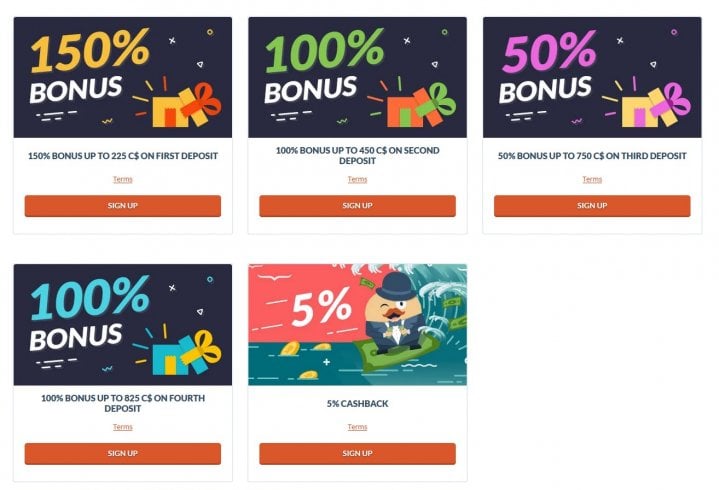

The new Sec. 45Z brush energy development credit are expanded due to 2029, and prohibitions are put on the usage of foreign feedstocks. In accordance with the ‘One, Larger, Beautiful Bill’, that it disliked tax actually heading everywhere, which means the brand new chairman has reneged on the his Social Defense guarantee to eradicate they. Bankrate has partnerships which have issuers and, although not restricted to, Western Show, Lender of The united states, Funding One, Chase, Citi and find out. The big victory from the Surf’s Up added bonus round are fifty minutes your lead to wager as much as 7,five-hundred coins.

The newest account develops income tax-deferred until membership people generate distributions, that will simply begin in the ages 18, plus the account at that point generally comes after the guidelines in the spot for personal senior years account (IRAs). Therefore, withdrawals, internet away from immediately after-tax benefits, made before decades 59 ½ is subject to regular taxation and you can an excellent ten percent punishment, with quite a few conditions, in addition to to have expenses (unlimited) as well as a primary-date family purchase (around $10,000). The newest OBBBA can make permanent the fresh TCJA’s lengthened son taxation credit (CTC) for each and every qualifying man, with a few modifications. The brand new CTC is actually arranged in order to return to the reduced peak well worth as much as $1,one hundred thousand inside the 2026 before OBBBA, off away from $dos,000 inside the 2025. Regulations advances the restrict CTC add up to $2,200 inside the 2025 and you can adjusts the value of the credit to have rising prices shifting, while you are firming qualification laws.

Away from $step one,600 for each qualifying personal if they are married otherwise $2,100 when they single and never an enduring partner. The OBBBA brings an additional, separate deduction to possess older people out of $6,100000 for every individual of 2025 as a result of 2028, and have helps it be offered to itemizers. The fresh deduction often stage aside at the a good six % price whenever changed adjusted gross incomeFor people, revenues is the total of the many earnings acquired out of any origin prior to taxes or write-offs.