Mastering the Forex Market: Strategies for Successful Trading

The forex market, characterized by its liquidity and 24-hour trading, attracts millions of traders seeking to capitalize on currency fluctuations. One of the key components of successful trading in this dynamic environment is having the right information and tools at your disposal. Whether you’re a beginner or a seasoned trader, understanding the essentials of forex trading is paramount to your success. For those interested in choosing a reliable trading platform, the trading forex Trading Broker ID can provide insightful resources and information.

Understanding Forex Trading

Forex trading, or foreign exchange trading, involves the buying and selling of currency pairs. A currency pair consists of two currencies: the base currency and the quote currency. For instance, in the currency pair EUR/USD, the euro is the base currency, and the U.S. dollar is the quote currency. Traders earn profits by speculating on the price movements of these pairs, buying when they expect the price to rise and selling when they anticipate a decline.

The Importance of a Trading Strategy

Developing a robust trading strategy is essential for success in the forex market. A trading strategy outlines how a trader will make decisions regarding buying and selling currencies. It typically includes the trader’s goals, risk tolerance, and the tools and techniques they will use to analyze the market. Common trading strategies include:

- Scalping: Involves making numerous trades throughout the day to capture small price movements.

- Day Trading: Traders open and close positions within the same trading day to take advantage of short-term price movements.

- Swing Trading: Aims to capture price changes over a few days to weeks.

- Position Trading: A long-term approach where traders hold positions for weeks, months, or even years.

Technical vs. Fundamental Analysis

To make informed trading decisions, traders employ two primary analysis methods: technical analysis and fundamental analysis.

Technical Analysis

Technical analysis involves studying price charts and using various indicators to predict future price movements. Traders analyze historical price data to identify trends and patterns. They often use tools like moving averages, relative strength index (RSI), and Bollinger Bands to assist in their decisions.

Fundamental Analysis

Fundamental analysis focuses on the economic, political, and social factors that can affect currency values. Traders who use this method analyze economic indicators like interest rates, employment reports, and gross domestic product (GDP) growth to gauge market sentiment and make informed predictions. For example, a rise in interest rates in a country typically strengthens its currency as investors seek higher returns.

Risk Management in Forex Trading

One of the most critical aspects of trading is managing risk. Forex trading can be highly volatile, and understanding risk management helps protect your capital. Here are some essential risk management strategies:

- Setting Stop-Loss Orders: A stop-loss order automatically closes a trade when the price reaches a predetermined level, limiting potential losses.

- Position Sizing: Adjusting the size of each trade based on the amount of capital you are willing to risk helps manage overall exposure.

- Diversification: Spreading investments across various currency pairs can reduce risk associated with individual trades.

- Emotional Discipline: Staying calm and avoiding impulsive decisions is crucial for maintaining a solid risk management strategy.

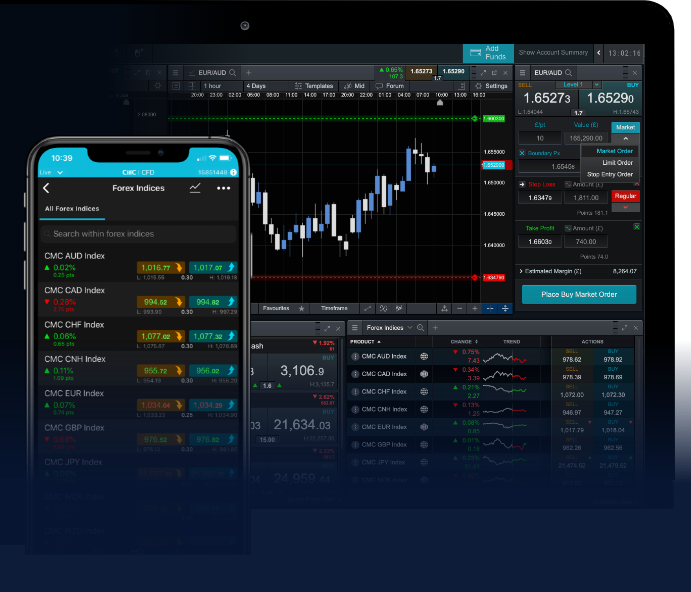

The Role of Trading Platforms

The platform you choose for trading can significantly impact your trading experience and success. Trading platforms provide tools for analysis and execution of trades, and there are several factors to consider when choosing one:

- Ease of Use: The platform should be user-friendly, especially for beginners.

- Tools and Features: Look for platforms that offer advanced charting tools, market analysis, and a variety of order types.

- Commissions and Spreads: Understand the costs associated with trading on the platform, including spreads, commissions, and any other fees.

- Customer Support: Reliable customer support can make a difference when you encounter issues or have questions.

Continuous Learning and Adaptation

The forex market is constantly evolving, with new economic data and geopolitical events influencing currency movements. Continuous learning is essential for staying ahead. Here are some ways to enhance your trading knowledge:

- Reading Books: There are numerous books on forex trading strategies, technical analysis, and market psychology.

- Online Courses: Many platforms offer courses designed for different skill levels, from beginners to advanced traders.

- Following Market News: Staying informed about economic news and global events can help you anticipate market movements.

- Joining Trading Communities: Participating in forums and chat groups can provide insights and support from experienced traders.

Conclusion

Forex trading can be an exciting and profitable endeavor if approached with the right knowledge and strategies. By understanding the market’s dynamics, developing a robust trading plan, managing risk effectively, and continuously learning, traders can enhance their chances of success. For those looking to start or improve their forex trading journey, leveraging resources like Trading Broker ID can provide valuable insights and support. Remember, every trader has unique experiences and paths, but with dedication and discipline, anyone can master the forex market!