The Advantages of Forex Trading

Forex trading has gained immense popularity over the last few decades, and for good reason. The foreign exchange market offers numerous advantages that attract millions of traders worldwide. One of the key benefits is that the forex market is accessible to anyone, anywhere, as long as they have an internet connection. This means that even individuals with limited capital can partake in trading. If you are considering entering this exciting market, exploring advantages of forex trading Kuwait Brokers might be a good starting point.

High Liquidity

One of the primary advantages of forex trading is its high liquidity. The forex market is the largest financial market globally, with a daily trading volume exceeding $6 trillion. This substantial turnover ensures that traders can buy or sell currency pairs at any time without significantly affecting the market price. High liquidity makes it easier for traders to enter and exit positions, leading to reduced transaction costs and minimal slippage.

24-Hour Market Accessibility

The forex market operates 24 hours a day, five days a week. This continuous trading cycle allows traders to participate at their leisure, regardless of their time zone. This flexibility is particularly beneficial for those with full-time jobs or other commitments. Traders can choose to operate during peak trading hours when market volatility is highest or trade during less active hours, depending on their strategy and risk tolerance.

Leverage Options

Another significant advantage of forex trading is the use of leverage. Many forex brokers offer traders the ability to trade on margin, which means they can control a larger position with a relatively small amount of capital. Leverage can amplify profits, allowing traders to earn significant returns on their investments. However, it is essential to remember that leverage also increases risk, and traders should manage their positions carefully to avoid substantial losses.

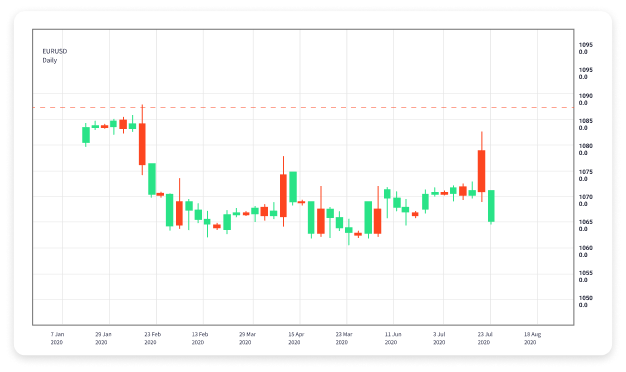

Diverse Trading Opportunities

The forex market offers a wide range of currency pairs for trading, providing traders with numerous opportunities to capitalize on price fluctuations. From major pairs like EUR/USD and USD/JPY to exotic pairs such as EUR/TRY, traders can diversify their portfolios based on their market insights and risk appetites. This diversity enables traders to explore various strategies and find niches that align with their trading styles.

Cost-Effective Trading

Forex trading is known for its low transaction costs. Unlike other financial markets, forex often has tight spreads, which means traders can execute trades at competitive rates. Additionally, many forex brokers do not charge commissions, allowing traders to maximize their profits. This cost-effectiveness is especially appealing to beginners looking to minimize their expenses while learning the ropes of trading.

Ability to Trade Long and Short

In the forex market, traders can profit from both rising and falling markets. If a trader anticipates that a currency pair will increase in value, they can go long (buy). Conversely, if they believe a currency pair will decrease in value, they can go short (sell). This flexibility adds to the allure of forex trading, as traders are not limited to profiting only in bullish markets.

The Impact of Global Events

Forex trading is heavily influenced by economic and political events around the world. As a trader, you can capitalize on changes in interest rates, economic indicators, and geopolitical developments that affect currency values. Staying informed about global events can provide traders with opportunities to leverage market volatility to their advantage, leading to potential profits.

Availability of Educational Resources

As the forex market grows, so does the availability of educational resources. Numerous online courses, webinars, and forums are dedicated to helping traders learn the intricacies of forex trading. This wealth of information supports both beginner and experienced traders as they refine their skills and trading strategies. Access to such educational tools allows traders to make informed decisions based on solid knowledge.

The Influence of Technology

The role of technology in forex trading cannot be overstated. Various platforms offer sophisticated trading tools, charting options, and automated trading systems. These technological advancements enable traders to analyze the market effectively and execute trades quickly. Additionally, mobile trading applications empower traders to stay connected with the market while on the go, ensuring they never miss an opportunity.

Community and Networking Opportunities

The forex trading community is vast and diverse, providing traders with numerous networking opportunities. Engaging with fellow traders can offer valuable insights, sharing of strategies, and support during the trading journey. Online forums, social media groups, and trading platforms can connect individuals, fostering a sense of camaraderie among traders from different backgrounds and experiences.

Conclusion

Forex trading offers a plethora of advantages that make it an appealing market for individuals looking to invest and grow their capital. From high liquidity and 24-hour market accessibility to leverage options and cost-effective trading, this dynamic market has something for everyone. However, it is crucial to approach forex trading with caution, using education and sound strategies to navigate its complexities successfully. Embrace the possibilities that forex trading can offer, and you may find it to be a rewarding venture.